Can AI do my Bookkeeping?

Seems like the sort of job that an LLM ought to be able to handle in this day and age.

Bookkeeping has always felt like something that I ought to be able to manage myself. My business is pretty simple, and I’m more than sufficiently fluent in finance to fully understand my business from that perspective. Somehow, though, the chart of accounts and journal entries and other bookkeeping things have been sufficiently mysterious to me that I’ve just hired a bookkeeper to deal with it.

I’ve got three legal entities, and one guy who I found on Upwork has been doing the books for two of them. I formed the third one this year and have been putting off dealing with the books mainly because it saved me the $39/month QuickBooks Online fee for the better part of the year (to be clear, lest you think me an irresponsible business owner, I do stay on top of my finances in Google Sheets). I was planning to have my bookkeeper handle that one as well, but his communication has really dropped off, so I decided to try to find someone new.

Unfortunately, that didn’t go well. I just wanted someone to do my books on an hourly basis, but the first couple folks I talked to insisted on pitching me way-too-expensive flat-fee services in which they promised they’d be not just bookkeepers, but valuable business advisers! Hard pass.

So I turned where I always turn — ChatGPT. I had actually tried to see if it could do a sufficiently good job of walking me through my bookkeeping a couple of years ago, but it wasn’t up to snuff then. Two years in AI development time is obviously an eternity, so I was pretty hopeful about GPT-5.

Teaching Me a Thing or Two

Here’s my first prompt:

I need your help with bookkeeping. My new fund is incredibly simple financially, and I’m already tracking performance on a per-brand basis on Excel sheets, so my only bookkeeping need is to have something to give to my CPA come tax time.

So far this year I only have ~200 transactions, and moving forward I expect 30-40/month. They are basically all:

- Disbursements from my Amazon Seller accounts

- Amazon ads payments

- COGS and freight payments to suppliers

- Insurance payment

- Quickbooks payment

- One brand has a Shopify account (otherwise they’re all pure FBA), so money in from Shopify and money out to pay Shopify subscription

- Money in from investors for purchases and distributions out to investors

- Money going out to escrow for purchases of new brands

I keep talking to bookkeepers who want me to pay $500+/month and promise they’ll give me helpful financial insight yada yada yada which I don’t need or want from them. So I’m thinking I can just do this myself - it can’t be that hard, right? Since it’s just for taxes, seems like the easiest thing is to do cash accounting. Is that right? And then what else do I need to know + do here? I’ll bring you individual questions about how to handle particular transactions but for right now just give me the high level. I’m using QBO on a cheap subscription.

Sure enough, it replied starting with, “Short version: yes, you can absolutely do this yourself, as long as you’re disciplined and a bit intentional up front. The only “non-obvious” part is investor capital accounting and how you treat acquisitions/inventory for tax.”

From there, it walked me step by step through every single thing I needed to do. The only things it got wrong were the locations of menus and sub-menus in the QBO UI.

It really shined in understanding my desire to do this in the absolute laziest (but still correct and sufficient for my CPA) way, while still making sure I understood the downside of the lazy choices I was making.

As an example, the disbursements of cash that I get from Amazon don’t represent my true revenue, because Amazon deducts most of its fees from my balance before sending me money. What my current bookkeeper does is to take the monthly Amazon payments report, which includes actual revenue as well as all of these fees, and enter that into QuickBooks manually. He then breaks it down into the individual fees that Amazon charges, so my reporting actually shows the fulfillment, referral, inventory, etc. fees.

The thing is: I don’t care (again, not financially irresponsible, just tracking this elsewhere). I only realized he was doing this because I reviewed the books after talking to ChatGPT. I’ve been paying him to do all of this manual data entry that has no value to me. I am very cheap and this hurts my soul.

You might think that my CPA needs all of this info, and you’re sort of right. He needs to know revenue and expenses, but he doesn’t need to know how much money went to fulfillment vs. inventory storage vs. promotion fees vs. returns on a monthly basis. Basically all that matters to him is revenue, expenses and inventory. ChatGPT’s solution? Just send him the Amazon summary for the year with those numbers when I send my books. Problem solved!

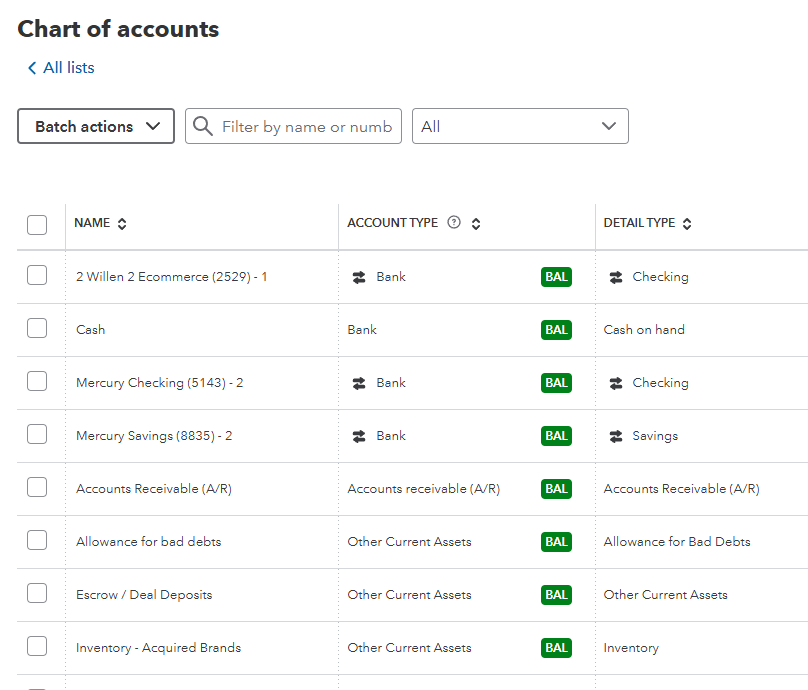

But I digress. The point here is that ChatGPT walked me through account setup then answered every single question I had about transactions with exact, specific instructions on what to do. I was its mere meat puppet, clicking and typing as instructed.

But Can AI be Trusted with my Books?

The favorite refrain of many AI skeptics is relevant here — how can I hand off something important to AI, knowing it hallucinates/makes mistakes/etc.?

My response: I suspect the guy who I found on Upwork who charges $10/hour has probably made mistakes in his work.

Just like with my human bookkeeper, I’m not blindly trusting AI here. As I’ve said, while some of the specific of bookkeeping are outside of my expertise, I know the fundamental financials of my business very well. Before I send my P&L and balance sheet to my CPA, I give them a sanity check.

It’s trivial for me to go to Amazon and see how much revenue I brought in and how much Amazon paid out. I know what my profit margin should be. I know how much inventory I have at the end of the year and what that cost. If any of the important numbers are way off, I’m going to catch it.

Sure enough, I pulled up the P&L for this year for the books that ChatGPT helped with, and everything lined up as expected.

At the end of the day, this stuff is just not that hard. There are some specifics that you need to understand around how to account for things, but once you know those it’s straightforward. If you keep up with AI, it should not surprise you that current LLMs are up to the task.

I will caveat this by saying that my businesses are very simple. It’s mostly just money in from sales and money out for buying + shipping inventory, and paying for ads and a new other expenses. Can GPT-5 handle the books for a large corporation with complex finances? Honestly I kind of suspect the answer is yes with the right scaffolding, but you probably shouldn’t take my word for it.

Removing the Meat Puppet

I wrote all of the above sometime around October of 2025. It was followed by a section about what it would take to fully use GPT-5 as a bookkeeper. I have removed it because it’s mostly irrelevant given soon-to-be-discussed advancements in AI, but here’s the quick summary:

The problem with the approach of asking GPT-5 how to do my books is that it saved me the cost of paying my bookkeeper at the expense of the time I spent doing what AI told me. That’s a bad trade. My bookkeeper is not that expensive, and my time is very precious.

What I really need is a solution where I give AI the same information I’d give my bookkeeper, and then AI actually updates QuickBooks without me needing to act as its intermediary/meat puppet.

Good news: Claude Code with Opus 4.5!

I gave it a rough summary of what’s described in this article and asked if it could do my books for me. It suggested that I get an API key from QuickBooks to enable it to make the updates itself.

This one final meat puppet task was a pain — you can’t just get an API key to access your own QBO instance; you have to create an app, which means going through their whole security questionnaire — but I got that done, gave the key to CC, and now it can make updates directly instead of instructing me.

That said, I haven’t totally extricated myself from involvement here; I still have to give it the same context I’d normally give my human bookkeeper. As an example, when a business I’m purchasing has been transferred to me and I release the money from escrow, I have to let Claude know. Once it’s aware, then it can ask me for additional context if needed (e.g. how much of the purchase price was for inventory vs. the business itself) and then create the journal entry to move the funds out of the escrow account on my books.

The upside, though, is that as I integrate Claude into more of my business, it’ll increasingly be able to derive the necessary context from other information. I already have it helping with Asset Purchase Agreements, and if it has access to the APA for the deal then it’ll know how to attribute the purchase price to intangibles vs. inventory in the journal entry without me telling it.

A mildly tedious task that I do at the end of the year is figuring out how much inventory I have of each SKU. I go through each Amazon brand, jot down current stock and then send a list to my bookkeeper, so he can adjust the inventory account accordingly before closing the books. But do you know who already has access to all of my Amazon inventory? Yep.

So here we have a case where not only can AI replace my bookkeeper, but it can ultimately do a superior job by virtue of the fact that it has context well beyond anything a contractor could. It’s not tough to imagine this paradigm extending to other roles — if Claude takes on the work of my IP lawyer, for example, I no longer need to supply the information to file a trademark application, and in fact I don’t even have to ask it to file one because it knows that needs to be done immediately post-closing.

We are, I suspect, not so far the long-promised AI assistant with all of the context, intelligence and skills needed to proactively run a business. I’m doing my best to push the frontier of that here for the sake of science, Substack content and avoidance of tedious tasks, but the tools I’m building for myself with Claude Code will very likely become available to anybody pretty soon. CC doing my bookkeeping is a good example — there’s no special sauce at all; I just gave it an API key and the same info that I’d give my human bookkeeper. Intuit could deploy the exact same functionality to all of their customers with very little effort.

The implications of this on white collar work are, of course, very large, but I’ll spare you a bunch of opining on that and get back work asking Claude Code to do more of my work.